November 2015 Commentary

November 2015 Commentary

Gold

The extravagant move by US gold over the month of October, in hindsight, looks to have been exactly that. The rally above USD1190 had been mainly spurred by a string of weak data out of the US which showed the economy there was still struggling. This weakened the US Dollar and had the speculators buying gold. It all dissipated very quickly however, after the FOMC meeting. The suggestion that a December rate rise in the US may still be on the agenda, led traders to take an “all bets are off” approach. More hawkish comments and further good numbers saw USD gold down $100 an ounce in just over a week and threatening the relatively strong support level at USD1080 by the first week of November.

The US gold futures open positions which had swelled by 5 million ounces in October saw liquidation of over 3 million ounces, reducing these speculative positions by 75% and undoubtedly clearing out some investment capital at the same time.

Where it goes from here will again be dependent upon further data and whether there is still some further liquidation to be done after the extended run-up. The Indian and Chinese buyers were definitely not a part of the rally during October but with Diwali and the Wedding season in India and the generally lower prices, there is a good chance that physical buying will again start to show itself in these centres.

In another interesting development it appears that the government concessions for refiners bringing metal into the India still sees to be attracting a large supply of gold that even its large physical market is struggling to deal with. China is also going through a “soft patch” in terms of economic growth which may continue to hinder outright buying demand for gold there.

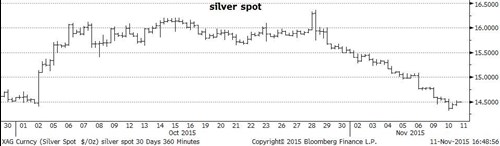

Silver was dragged along for the ride as the gold rallied hard, but once again, the USD16.50 level proved too hard to crack. The gold/silver ratio stayed stoically around the 73:1 level through the course of the rally and it is only now starting to show signs of breaking down to the 75:1 area again as the typical overreaction to any price action (particularly on the downside) begins to take effect on the infamously volatile silver market.

Interestingly, silver was also experiencing a supply squeeze at the same time, which had started back in August. It wasn’t a lack of supply overall but a lack of good quality .9999 silver and a cleaning out of meagre silver coin supplies (particularly in the US) which created some premiums for high quality physical silver. As is so often the case, the squeeze finished at about the same time as the gold price started to tank and stocks from unusual sources (such as Poland) that had been mobilised because of the premium, had no place to go. The tail end of this liquidation is probably what has driven the silver price lower (relative to gold) in the last week or so.

The important question now is to see whether silver can find its footing again at these lower levels, which will be partially dependent on where the gold price goes but also, if it picks up a USD13 handle again, whether the demand elasticity that showed itself last time it took a dip to this level, will again reappear.

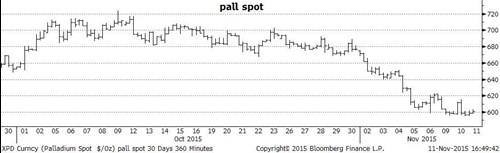

Platinum and palladium continued to be influenced partly by the other precious metals markets and the VW diesel scandal. The speculation that the upgrading of catalytic converters and retro-fitting of compliant ones would lead to a pick-up in demand for the PGMs largely dissipated and again the timing seemed to coincide almost perfectly with the fall in the gold price.

Platinum, which had been dithering around the USD1,000 per ounce level for a couple of weeks, took a header and is now struggling to hold the USD900 level. The discount of platinum to gold also took a beating, moving from around US150 discount to US190 discount to gold in fairly quick time.

Platinum copped a double-whammy with net speculator short positions increasing dramatically at the end of October and continuing into November and some solid selling out of the ETF’s globally to the tune of around 155,000 ounces.

In support of the PGMs, however, the auto market did fairly well over the period, with sales in the US of around 18 million units (compared with 16.8 million units for the same month in the prior year). The cheaper fuel prices have led to higher purchases of larger vehicles but this is probably a one-off that will impact further sales going forward.

The other individually supportive factor for Platinum, which is currently being largely ignored, is the fact that around two-thirds of the South African platinum production is operating at a loss at these prices. The political consequences of closing these mines and the resultant flow-on effects into unemployment and strike action are, for the time being at least, outweighing the economic implications of operating and not being able to cover costs. This scenario realistically can obviously only go on for so long.

The impact of this conundrum, at the moment however, in a typical counter-intuitive fashion, is that supply is actually ramping up. This is adding downward pressure to an already weak price, as mines attempt to get as much product into the market and generate as many dollars as possible, regardless of the net bottom line.

Any actual closure of the mines, however, may make the whole market re-think the price expectation on platinum from here and could cause the short-position holders to consider taking some profit.

For palladium, specifically, the view that petrol rather than diesel cars will be selling in higher numbers because of the VW scandal, has provided a little more support for the metal most widely used in their catalytic converters.

It is, however, still a decidedly weak market.

The other supportive factor for palladium has been the scaling back of the huge short position that has been building up since May this year.

Like platinum, however, the palladium market has seen some large outflows from the ETF markets as well and around 330,000 ounces leaked out of the world-wide holdings during October.

Palladium can also be somewhat comforted by the fact that it has hit some of its significant support levels down at around this US600 per ounce level and this will make the technicians (and some of the speculators) more inclined to buy down here and make the short-position holders very wary of any rally from this levels.

Cast Bars

Cast Bars  Minted Coins

Minted Coins  Minted Tablets

Minted Tablets  Granules

Granules  Custom Coins & Bars

Custom Coins & Bars