March 2016 Commentary

March 2016 Commentary

Gold

After the tearaway performance for the start of the year, gold has started to show signs of topping out in the high 1200’s, failing to breach the hoped for USD1300 level. It is now starting to feel the effects of some of the inevitable profit-taking and the weight of producer selling is also taking its toll. This could still just be a consolidation phase before another run higher but economic data out of the US and China does not appear to be as ruinous to the recovery of the world’s economy as perhaps was first thought.

Having said that, Janet Yellen’s testimony on 16th March which pushed any further rate hikes down the road inspired the bulls to add to their positions and scared out any nervous shorts who thought gold was heading below USD1200 in short order. Less than impressive data out of the US also gave the speculators reason to take it back up to the USD1262 level again. The long positioning now in the speculative markets of choice (the gold ETF’s and futures) is now, however, at multi-year highs.

Bets have definitely been placed and now the emphasis will be on the ability for the market to deliver on the projected anticipated path. The risk, as usual, is that there is a surprise the other way and with the relatively rapid rise in the market and the lack of consolidation to create valid support levels, a break back down through USD1200 could see the market run quickly back to the USD1150 level. At that point it will rely on the longs to be “sticky” and the resolve of the bulls to be maintained.

On the upside, the USD1300 is still the main target and above that level further profit taking and more concerted selling from the producers will probably appear. In the right environment, however (where the US recovery appears to have run off the rails and China continues to struggle) it could carry straight on through and up towards USD1350.

In the physical market, the Chinese have been net sellers of gold into this rally and the Indians have not been swept up in the buying fervour. Premiums for gold in Hong Kong are flat and the demand there for kilobars can be described as sluggish at best.

After waiting for the announcement from the government about an expected reduction in import duties, the Indian traders and jewellers were surprised by the government actually lifting the import tax by 1% to 11%. At the same time the break given to importers of dore into the country were given a further incentive by the government when the duty on imported dore was only raised by .75%. This means that importers of dore now have an advantage over importers of finished gold to the tune of 2.25%.

The rationale behind this move in a scenario where India is already importing a record amount of dore and gold is running at a $35 discount, is interesting to say the least. Obviously the view of the government is that dore needs refining which creates jobs and investment in India, which is to be encouraged. The full effects of this differentiation and the definitions and classification of metal imports are already being tested, but there is no question that it has severely skewed the statistics around the make-up of Indian gold imports. As a testament to the change this policy is making, Indian gold bar imports for February were at a record low of only 23 tonnes.

Silver

Follow the leader was again the catchcry for silver this month. It has, however, performed slightly better in the pullback scenario than has gold. The gold/silver ratio which blew out to 83:1 as gold peaked at USD1282 is now back at a more respectable 80:1 and demand for silver is still readily apparent from investors who view the US15.00 level as “relatively cheap” in this environment.

With its quasi-industrial stature in the market and its loose connection with the PGMs, silver has also benefitted from the rallies in platinum and palladium. Substitution is now becoming more prevalent in scenarios where silver can be used in industrial processes instead of gold (or indeed platinum and palladium).

Platinum and Palladium

Platinum and palladium both went for a run on the upside during the month as the physical demand for the metals (in particular out of China) finally spurred some of the short positions to cover.

Platinum reached a high back over the USD1,000/ ounce (a level not seen since late last year) but had given back some of the gain by mid-March. Chinese jewellery demand in particular (and their preference for white gold rather than yellow gold) played a big part as one of the perceived drivers of price in platinum. Ordinary profit numbers for the big South African platinum producers probably also helped to drive home the message that the cost/revenue balance is not good for some of these companies (and unsustainable in the long term at levels of USD800 per ounce even with the benefits of a weakening Rand).

Below is a chart of the Platinum price denominated in Rand to show how it has reached the higher levels but also, notably, how it appears to be plateauing now.

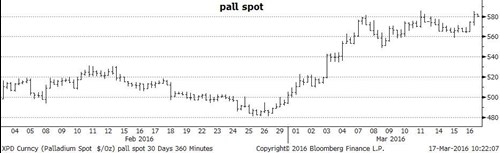

Palladium also saw some short-covering and outright buying as, again, the physical purchases of metal started to impact ready availability, highlighting the disparity between the speculative interest and the physical market that has pervaded trading for the last few months.

The auto catalyst market makes up 80% of the demand for palladium and China’s share of that demand is around 22%. With automotive production continuing to increase (regardless of the softer economy), the imports into China increased to 2.6 metric tonnes in January and the impact on above ground stocks frightened even the most hardened palladium bear into at least considering taking their profit and covering up.

Once the USD520 level was breached the rally started to gain some momentum and it hasn’t really looked back since.

In all, the growth stories in the US and China are still the overriding drivers of all of these markets and the current picture is still not clear. This leaves the precious metals markets balanced on a knife’s edge with the current volatility in prices (particularly in gold), highlighting this uncertainty.

Perhaps next month some greater clarity as to the direction of metals will be available and some semblance of range trading markets may be accommodated.

Cast Bars

Cast Bars  Minted Coins

Minted Coins  Minted Tablets

Minted Tablets  Granules

Granules  Custom Coins & Bars

Custom Coins & Bars