January 2016 Commentary

January 2016 Commentary

Gold

After falling over the line with a decidedly soggy sail for the end of the calendar year, gold started the new year with a bang (literally). North Korea’s decision to undertake some nuclear testing at the same time as stock markets around the world (and particularly in China) took an early hammering, left gold as the obvious choice of investment to start 2016. Hedge funds with cash to invest and a largely clean sheet as well as the lead into the Chinese New Year also added fuel to the gold buying spree. By the end of the first week of (admittedly thin) trading, gold was back above USD1100 an ounce and with the AUD getting trashed straight out of the blocks as well, the AUD gold price was up over AUD100/oz or around 8% in 5 days. Not a bad start to the year for some. Unfortunately, however, history shows that the start of the year is not necessarily a good indicator for what will happen for the rest of it.

This time last year gold rallied strongly through January as well with US gold moving above $1300/oz, only to give back all its gains (plus more) over the rest of the year. So the question now becomes whether this is a new dawn for gold or simply an exuberant “blow off” celebration.

Once again the pace and size of interest rate hikes in the US probably hold the key. At the moment there is a great deal more “dovish” chatter on rates suggesting that the speed with which rates need to rise in the currently benign inflation scenario is not as rapid as some were suggesting at the end of last year. Indeed the forward interest rate curves in the US are all now coming down (in percentage terms) as the impact of this view takes effect. The 10 year US bond rate has come down from a level of over 2.20% in December to under 2.00%. This all assists the “buy gold” camp.

On the physical side, the traders are not buying into the argument here and will prefer to wait for a pull-back of some kind before taking on more stock.

The Shanghai Gold Exchange continues to show large draws of gold out of its vaults but where it is going and whether it is being cycled back in through other means still seems to be a large unknown from the information available.

Silver

Silver has gone along for the ride, once again, but it is underperforming gold. The gold/silver ratio has blown back out to the relatively high 79:1 level but this is only to be expected in a geo-politically charged environment. Silver stocks of high grade .9999 material are now readily available after the run seen in August, September and into October and so the speculative interest has again taken the back seat.

It does appear that some of the physical buyers have taken advantage of the sub-USD14.00 level again to replenish inventory but with the recent rally in the last few days, this has now faded as well.

The slow world growth and the fears of a hard landing for China’s economy is definitely impacting the perception of silver’s value as an industrial metal as is the case with the Platinum Group Metals as well.

The impact of more frugal use of silver in industrial applications (particularly photovoltaic plating) is also having an effect on silver not to mention the continual decline of its use for photography which is also impacting X-Ray technology now.

The US and India are still taking good volumes of silver for investment, however, and India has taken close-to-record amounts of the grey metal in the last year. The stoic ETF holders also continue to generally maintain their long positions with the over-riding view being that the downside in price is limited from current levels.

Platinum and Palladium

Platinum finally found some even footing this month and rallied from the lows of around US830/oz to sit at around US875 by the first week of the new year.

Although, as mentioned previously, a large proportion of the South African production is uneconomic at current USD prices, the Rand has plunged during the year as well providing some breathing space for the producers there. This means that the unsavoury consideration of closing some mines and taking the heat on the economic and unemployment implications of such a move, has been kicked down the road (for the time being at least).

Platinum is still struggling with the issues of its real demand for use in diesel vehicles as well. Although the VW scandal has been largely swept aside now, the whole question of diesel-powered vehicles has been called into question because of their generally higher emissions. A continued backlash in Europe as a result of this concern will impact total sales and in turn, overall demand for platinum.

The upside for platinum is probably going to rely on short-covering from speculators who have enjoyed the ride down so far but may be spurred into action if the price can rally above US900 again.

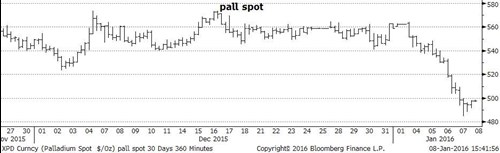

Palladium still has better fundamentals than platinum for its use in catalytic converters but is still struggling under the weight of short positions and negative sentiment about the Chinese economy. China has been a huge contributor to palladium’s popularity in the last 5 years and so the plummeting Chinese stock market in the first week of 2016 impacted palladium most severely of all the precious metals. Once the USD520 level gave way it fell quickly through 500 where it finally found some support.

The metal saw further short positioning and has also seen some capitulation from long-holders in the ETFs who bailed out as it plunged below US500/oz.

Having said that, like platinum, it is finding some support at the levels just below this price and a rally above US500 again in the right news environment from the Chinese side may spark some short-covering, particularly in the NYMEX market where a considerable amount of the positions are being held.

Overall, unlike gold, it has not been a great start for the PGMs this year.

Cast Bars

Cast Bars  Minted Coins

Minted Coins  Minted Tablets

Minted Tablets  Granules

Granules  Custom Coins & Bars

Custom Coins & Bars