February 2016 Commentary

February 2016 Commentary

Gold

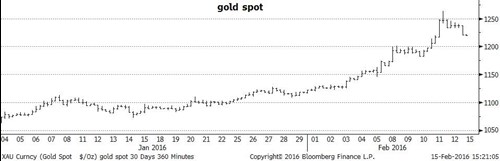

Gold has continued on its tear this month with seemingly no end to the reasons to buy gold after the panic to sell it into the end of last year. USD gold is up around 17% this year and is one of the best performing asset classes for 2016 so far.

The reasons espoused to buy gold include; the weaker China growth story, the very weak stock markets, the dovish tone set by the Fed after the initial rate hike and the lower oil price implications. Of all of these, probably the lowering of expectations for a rapid set of interest rate hikes in the US (and even talk of the US considering negative interest rate scenarios) has probably been the most important.

Interestingly, when the gold first made its run above USD1,000 in the late 2000’s one of the reasons specified was the implication that the rapidly rising oil price would make inflation run out of control. Now it seems a rapidly falling oil price is also a reason to buy gold. As usual the markets are often much more about a story line, market perception and spin than the reality of what is actually going on in the world economy.

From a fundamental perspective there is no doubt that a large number of the speculators who were looking for gold to plumb the lows below USD1030/oz are now out of the market (and probably long). The speculative long positions on the futures markets have grown to multi-month highs but the speed and veracity of the rise has been such that, from a chartist’s perspective, it has left a large number of “holes” and gaps in the price series which is always a danger when a market moves rapidly in one direction. Corrections in this type of scenario can also be monumental and painful for participants.

It appears gold is now taking a breather around the USD1210 level and its job from this point on is to soak up the producer and scrap selling that will undoubtedly emerge with a price which is $160/oz higher than where it was at the end of the year. Its ability to hold levels on any downside correction will be the test of the commitment of the long holders and will also be key to its performance over the rest of the year.

Silver

Silver continued to tag along but also continued to underperform the star of the show. The gold/silver ratio threatened the 80:1 level once again and the USD16.00 level continues to be a seemingly impenetrable ceiling at the moment. The often prescient trading style of the silver speculator continues to persist and the adage of “taking profits when available” seems to still be the mantra of the battle-hardened silver trader.

Some of the steam has come out of the ETFs in the rally and futures positions have not been added to in the same gung-ho style of the gold market. The net length already in the silver market is probably to blame for this and will probably continue to weigh on the market through any persistent rally.

The demand out of India has abated somewhat with the rise in price but the demand out of the US (particularly for silver coins) has surged. American Eagle silver coin sales increased to almost 6 million ounces in January. This is a level not seen since January 2013.

Overall demand for silver, however, has been dented, with supply now much more readily available than it was a few months ago.

The ongoing fragility in the silver market is already being evidenced by its over-reaction to the pull back (although potentially only a consolidation) of the gold price currently underway.

Platinum and Palladium

Platinum had a reason to rally this month and willingly obliged. With word of the potential for further future strike action in South Africa as workers push again for higher wages, there is once again a threat to supply. It is, however, probably a relatively small hiccup and a storm in a teacup which seems counter-intuitive in a market where the producers are already struggling to meet their cash costs and remain economic and in a world where labour costs in the mining industry are generally only going one way - down.

As proof of the struggle going on in South Africa around platinum, Impala Platinum Holdings (the second largest producer of the metal) has literally just announced an expectation that its first half profits may fall by as much as 30%. Hardly an environment where a company wants to be facing requests to increase workers’ wages.

A conspiracy theorist could argue that this rumour of strike-action was exactly what the platinum market needed to push its price up and force some short-covering from the speculators who have seemed to be nonchalantly confident that the platinum price was not going up anytime soon.

It did, however, have the desired effect.

Platinum rallied from the depths of around USD800/oz to a high of USD975 before again drifting lower as gold corrected.

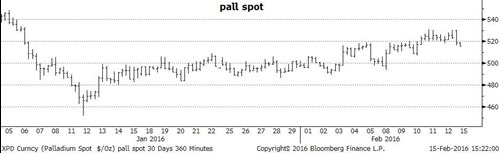

The fact that the China growth story and its continued trajectory is still top-of-mind for many traders means that the palladium market (which relies so heavily on diesel car demand) is still in a state of flux. It did enjoy a good rally as the gold market picked up and, like platinum, some shorts were forced to cover but a more positive world growth story is probably required to keep the momentum going.

Like the other precious metals, palladium seems quick to give up its gains as the gold price retreats and it looks like the whole precious metals complex is going to rely on gold to carry the baton into March if there is to be any hope of a sustained rally across the group.

Cast Bars

Cast Bars  Minted Coins

Minted Coins  Minted Tablets

Minted Tablets  Granules

Granules  Custom Coins & Bars

Custom Coins & Bars